|

| Romania’s September inflation of 8.8% was slightly above the market’s 8.70% forecast and the 8.45% estimate, ING bank reports.

Price pressures seem to remain rather broad-based, which makes ING’s 7.1% year-end forecast look rather optimistic. An “on-hold for longer” scenario seems to be taking shape in Romania as well. |

|

|

| The bank said it was somewhat hopeful for a Czech-style inflation reading in Romania this month, given that last month’s higher-than-expected inflation was attributable to one-off factors.

However, the disinflation process continues to look stickier than expected, be it for different reasons each month.

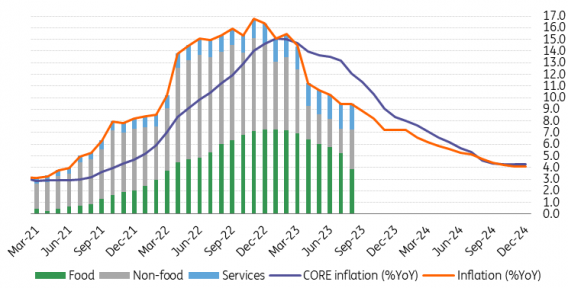

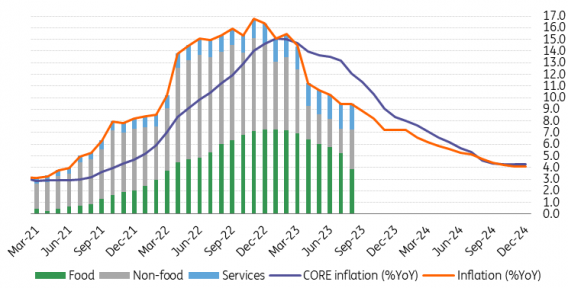

This time, we notice that price pressures have marginally exceeded our estimates in pretty much all categories, with service prices posting the largest deviation. This kept core inflation at 11.4%, also slightly above our estimate of 11.2%.

We still expect to see core inflation in single digits as early as November and to close the year below 9.0%. The outlook for 2024 remains largely unchanged, as the core is likely to stay above the headline rate while the spread between the two should narrow to below 1ppt around mid-2024. |

|

Inflation (YoY%) and components (ppt)

|

|

| Despite updating it every now and then, we’ve constantly had a below-consensus estimate for year-end inflation, currently at 7.1%, and for end-2024 at 4.1%. While we cannot say that the data flow is clearly working against our view, which we maintain, risks again seem skewed to the upside. We continue to expect 150 basis points of rate cuts from the National Bank of Romania in 2024, though we have shifted the starting point from the first to the second quarter, most likely at the April 2024 meeting.

Meanwhile, it is likely that any upward pressure on the EUR/RON will be used as an opportunity to mop up some of the excess liquidity from the local market, leading to a stable FX rate. As for the outlook on the liquidity itself, as uncomfortable as the central bank might be with the situation, the latest numbers (+29bn RON in September), together with the higher budget deficit target announced by the Ministry of Finance, make a return of liquidity levels to anywhere near the historical average quite unlikely for the foreseeable future.

|

|

Prospect of recession jumps above inflation as chief concern for retail investors