„With growth in total returns over the last 5 years of around 242%, only behind Hermès, and with revenues for the first quarter of 2023 up 16.8%, LVMH stock sets a new record, becoming the eleventh company in the world by largest capitalization and the first European company to cross the $500 billion mark, said Gabriel Debach, Market Analyst at eToro.

The French conglomerate is still far from American mammoths, with Apple leading the ranking with its $2.6 trillion (with its maximum peak of $2.94 trillion in December 2021) but showing a similar forward P/E both around 26x (26.7x for Apple and 26.6x for LVMH). Therefore, investors can still expect growth by the French powerhouse.

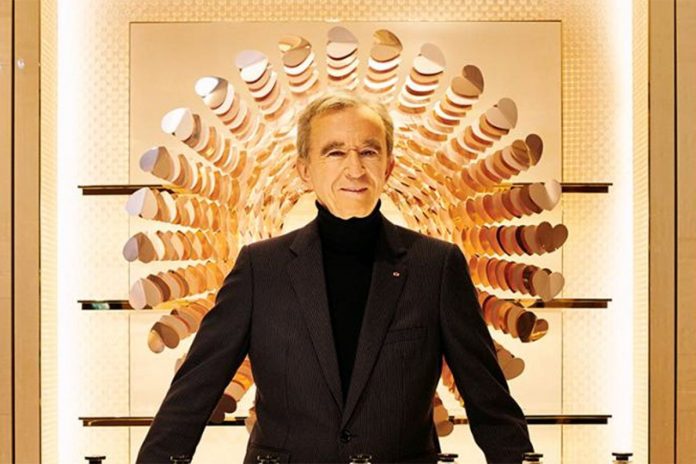

„Valuations that make Arnault Bernard the richest man in the world, according to the Forbes ranking, with his approximately $243 billion of assets, followed by the owner of Tesla Elon Musk ($175 billion) and Jeff Bezos ($130 billion). Fashion that surpasses American technology, highlighting greater resilience to inflationary fears and even the economic slowdown.

„Geographic diversification plays in favor of the luxury title, benefiting from the Chinese reopening as well as from the greater Japanese demand, so much so that the European and American markets together represent only slightly less than half of the total turnover (about 49.3%). Chinese reopening reporting the greatest outlook from management, with double-digit first-quarter momentum boding well for performance over the year.”

„Geographic diversification plays in favor of the luxury title, benefiting from the Chinese reopening as well as from the greater Japanese demand, so much so that the European and American markets together represent only slightly less than half of the total turnover (about 49.3%). Chinese reopening reporting the greatest outlook from management, with double-digit first-quarter momentum boding well for performance over the year.”

„Geographic diversification plays in favor of the luxury title, benefiting from the Chinese reopening as well as from the greater Japanese demand, so much so that the European and American markets together represent only slightly less than half of the total turnover (about 49.3%). Chinese reopening reporting the greatest outlook from management, with double-digit first-quarter momentum boding well for performance over the year.”